Table of Contents

- California’s Economic Outlook as Inflation Dips - Public Policy ...

- Thread by @skepticaliblog on Thread Reader App – Thread Reader App

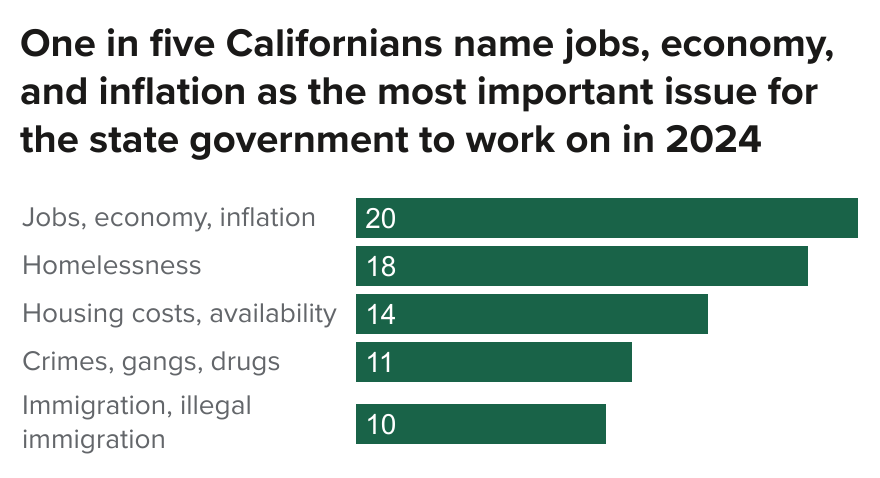

- PPIC Statewide Survey: Californians and Their Government - Public ...

- Widespread inflation fears in Southern California hit home in a key ...

- Making Sense of California’s Economy - Public Policy Institute of ...

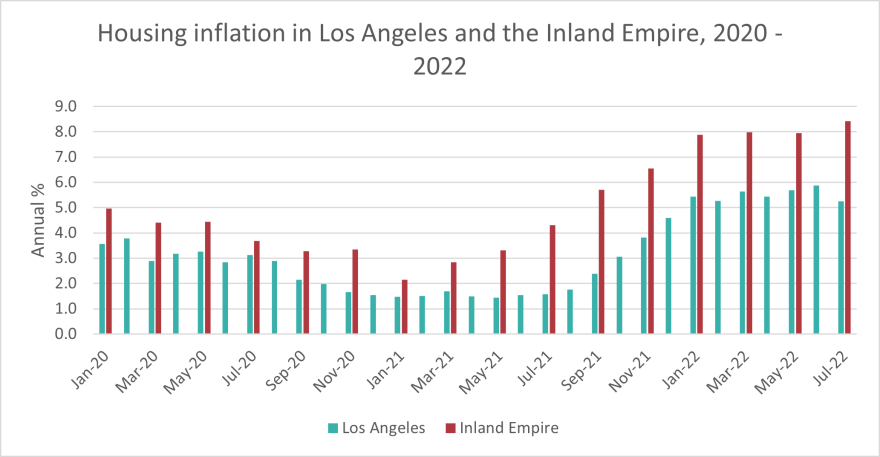

- Inland Empire experiencing higher inflation rate than Los Angeles and ...

- Southern California inflation rises 2.5%, highest in 6 years – Orange ...

- California Inflation Rate 2024 - Beth Marisa

- Inflation continues to rise in California. Here’s what economists say ...

- Southern California Inflation Reaches Highest Level Since 1982

Slowing Down of Inflation

Impact on 2026 COLA Projections

As reported by FedSmith, the 2026 COLA projection is currently at 2.5%, down from the initial projection of 3.2%. This decrease in the COLA projection is a result of the slowing down of inflation. While a lower COLA may not be welcome news for federal employees and retirees, it is essential to note that the COLA is still expected to be higher than the average annual increase in recent years.

What Does This Mean for Federal Employees and Retirees?

The slowing down of inflation and the lower 2026 COLA projection have significant implications for federal employees and retirees. A lower COLA means that the purchasing power of federal employees and retirees may not keep up with the rising cost of living. However, it is essential to note that the COLA is still expected to be higher than the average annual increase in recent years, and federal employees and retirees will still receive a benefit to help them keep up with the rising cost of living.In conclusion, the slowing down of inflation is expected to have a significant impact on the 2026 COLA projections. While a lower COLA may not be welcome news for federal employees and retirees, it is essential to note that the COLA is still expected to be higher than the average annual increase in recent years. Federal employees and retirees should stay informed about the latest developments and plan accordingly to ensure that they are prepared for any changes to their benefits.